The Paycheck Protection Program provides funds to aid in payroll and utility costs. They are forgivable so long as the funds are used for eligible expenses. Companies may use these funds for:

- Payroll costs

- Employee benefits

- Rent or mortgage payments

- Utilities

- Interest on debt accrued before February 15, 2020

On June 3rd, the US Senate passed additional PPP legislation that:

- Triples the time allotted for loan recipients to spend the funds and restore workforce levels to qualify for forgiveness

- Reduced the minimum amount of the loan that must be used for payroll expenses

- Adds a rule that this minimum amount must be met, or none of the loan is forgiveable

- Extends the repayment window from two years to five years, keeping the interest rate at 1%

- Allows businesses that took a PPP loan to also delay payment of their payroll taxes

Companies must apply for a PPP loan by June 30th and have until December 31st, 2020 to use these funds and be eligible for forgivability. PPP borrowers can choose to extend the eight-week window originally required to use funds, or keep the original eight-week period. The Senate passed this legislation to make it easier for more borrowers to reach full forgiveness.

Companies now also have until December 31st, 2020 to restore workforce levels and wages to pre-pandemic levels required for full forgiveness. The legislation also added two new exceptions that allow borrowers to achieve full PPP loan forgiveness even if workforce is not fully restored:

- Borrowers can exclude employees who turned down good faith offers to be rehired at the same hours and wages as before the pandemic from their workforce calculations

- Borrowers can adjust their workforce if they could not find qualified employees or were unable to restore business operations to 2/15/20 levels due to COVID-19 related operating restrictions.

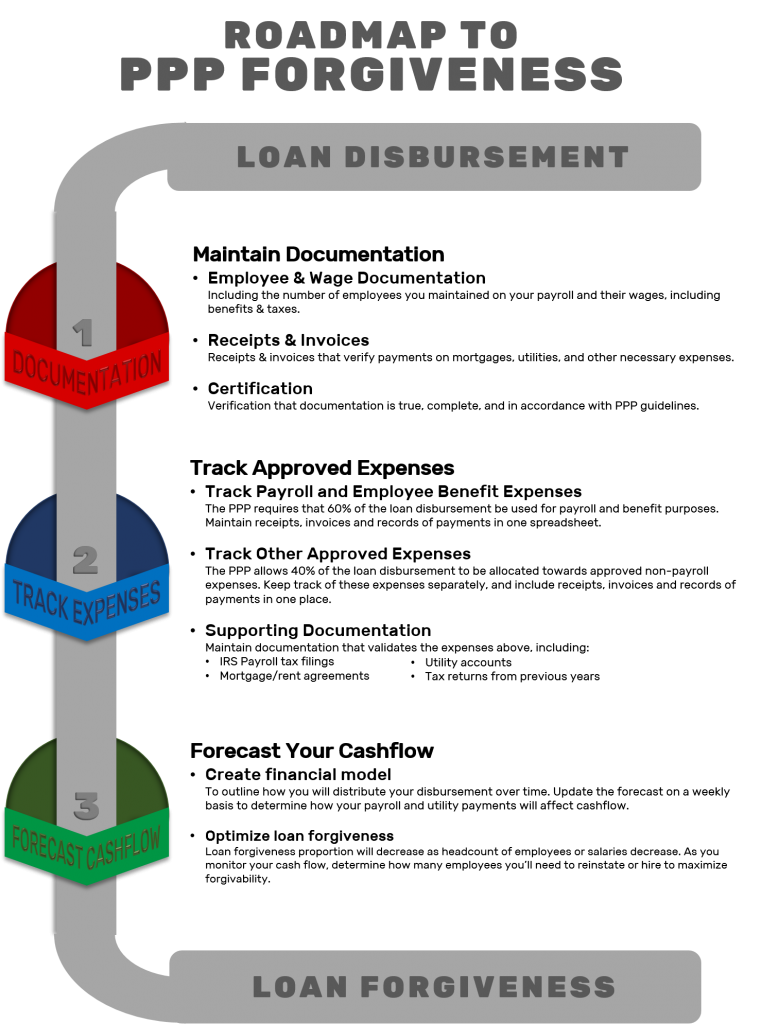

How to Maximize Paycheck Protection Program Forgiveness

In order to qualify for loan forgiveness, companies that receive PPP disbursement must use 60% or more of the funds for payroll and are limited to using 40% of the funds for other qualified expenses. Forgivability amount decreases as headcount and salaries decrease, so employers must keep accurate and detailed documentation of expenses to ensure compliance and maximize forgivability.

If you’ve received PPP funds, take the following steps to prepare the necessary documentation and minimize the reductions in forgivability.