90 Day Acquisition Integration

VIP SOLUTIONS CASE STUDY

Distribution

INDUSTRY

45

EMPLOYEES

$25M

ANNUAL REVENUE

BACKGROUND

Our client required a $25 Million tuck-in acquisition executed immediately after the platform purchase. The predecessor’s back office and accounting functions were remaining with the predecessor requiring expedited control implementation and transition cycle.

OBJECTIVES

Implement cash control over collections, disbursements and forecasting.

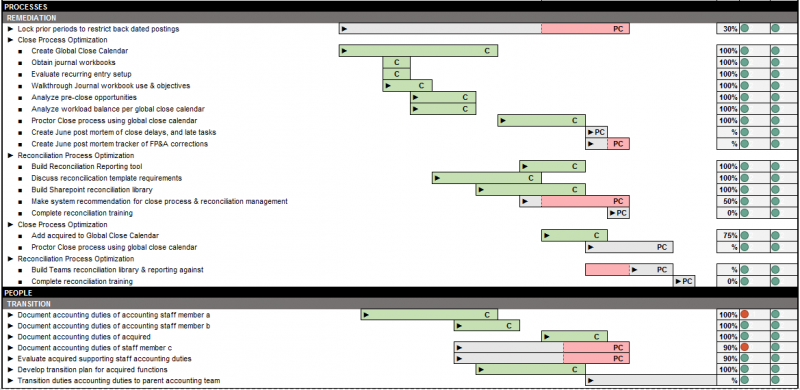

Implement close process and timeline aligned to the acquirer.

Implement flash reporting on days 3-5.

Prepare net working capital and purchase price allocation.

Transition controller duties to acquirer accounting team.

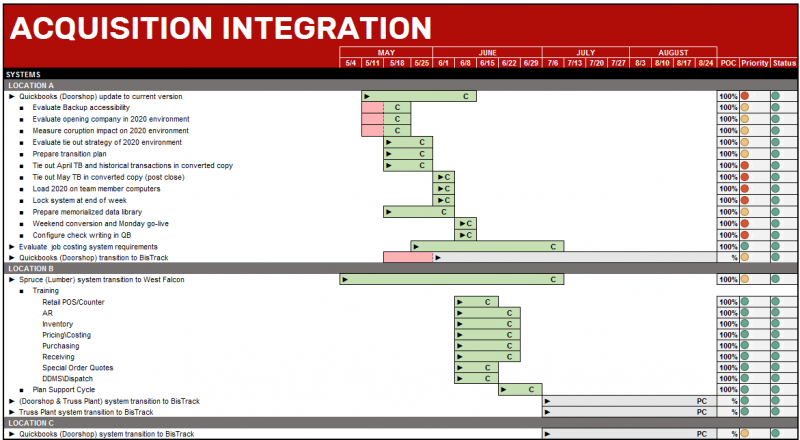

Prepare data tables for system integration.

SOLUTIONS

Implemented cash control and forecasting within first 30 days.

Implemented flash reporting, close and reconciliation in first close cycle under interim management.

Prepared net working capital deliverables resulting in desirable, on-time settlement.

Transitioned controller duties and supported on-time go-live of system transition.

After observing our methodical process, the client requested we execute the same transition process for the platform assets.