Manufacturing & Distribution

INDUSTRY

140

EMPLOYEES

$28M

ANNUAL REVENUE

VIP SOLUTIONS CASE STUDY

Manufacturing & Distribution

INDUSTRY

140

EMPLOYEES

$28M

ANNUAL REVENUE

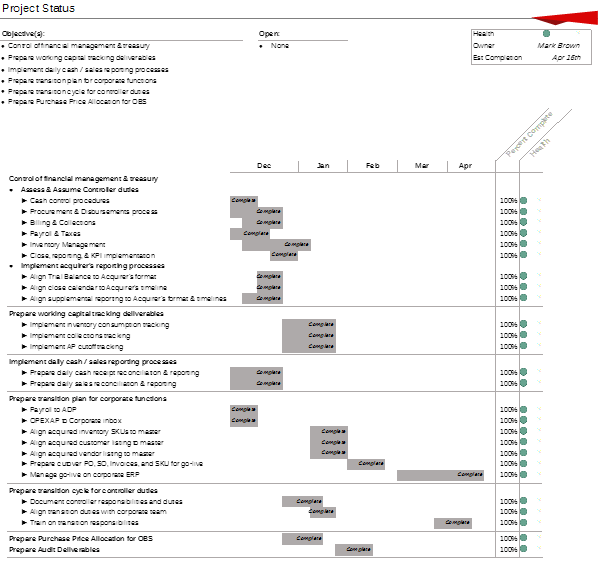

Our client maintains an aggressive acquisition strategy to gain regional market share. Our client desired a playbook to run their integration process repeatedly.

We used our playbook on this $28M tuck-in acquisition to integrate the Seller’s management, systems, and accounting functions into the platform in 90 days.

Implement cash control over collections, disbursements, and forecasting.

Implement close process and timeline aligned to the acquirer.

Implement flash reporting on days 3-5.

Prepare networking capital and purchase price allocation.

Transition controller duties to acquirer accounting team.

Integrate acquired business unit into platform systems.

Train and go-live on platform systems at acquired site.

Implemented cash control and forecasting within first 30 days.

Implemented flash reporting, close, and reconciliation in first close cycle under interim management.

Maintained net working capital tracking resulting in desirable, on-time settlement.

Transitioned controller duties and supported on-time go-live of system transition.