Financial Services

INDUSTRY

1,000

EMPLOYEES

$380M

ANNUAL REVENUE

VIP SOLUTIONS CASE STUDY

Financial Services

INDUSTRY

1,000

EMPLOYEES

$380M

ANNUAL REVENUE

A midsize, publicly-traded financial services company that conducts business operations through its various branch locations was required to adopt ASC 842, Leases, (“ASC 842”) effective January 1, 2019. Accordingly, the company disclosed the estimated impact of ASC 842 adoption in their 2018 year-end financial statements and ASC 842 adoption was reflected in their first quarter 2019 financial statements. As an accelerated filer, the company is required to attest to the effectiveness internal controls under S-OX.

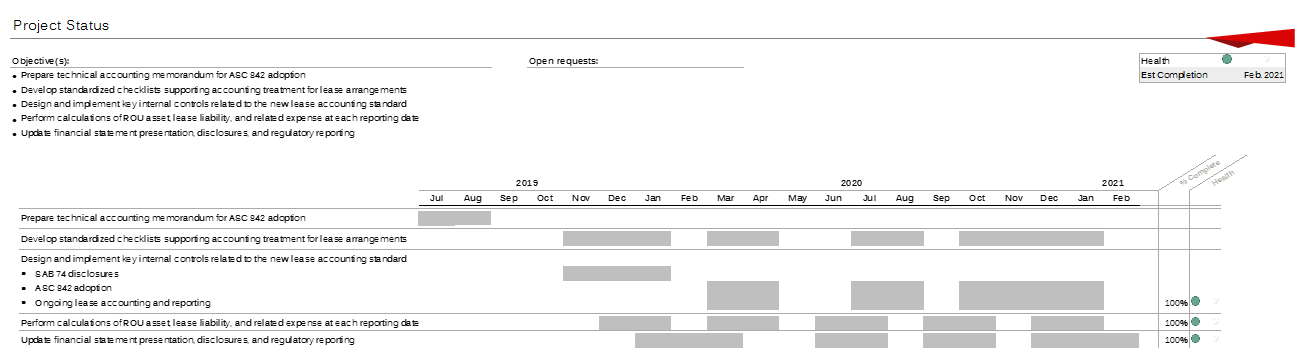

Prepare technical accounting memorandum for ASC 842 adoption

Develop standardized checklists supporting accounting treatment for lease arrangements

Design and implement key internal controls related to the new lease accounting standard

Perform calculations of ROU asset, lease liability, and related expense at each reporting date

Update financial statement presentation, disclosures, and regulatory reporting

Designed procedures and internal controls to identify all in-scope lease arrangements

Developed technical accounting memo documenting overall accounting treatment, policy elections and practical expedients

Prepared standardardized checklists to determine appropriate lease classification

Prepared walkthrough documentation of ASC 842 implementation and tested related internal controls

Calculated initial ROU asset and lease liability to include SAB 74 disclosure as well as interim and year-end periods subsequent to adoption

Successful adoption of ASC 842

Sufficient time for auditors to review and approve accounting treatment

No deficiencies in internal controls over ASC 842 adoption were identified

No audit or disclosure adjustments related the recorded ROU asset, lease liability, or lease expense were noted.

Accurate SAB 74 disclosure included in 2019 Form 10-K

ASC 842 presentation and disclosure appropriately updated beginning first interim period through year-end

Periodic status updates contributed to a successful adoption of ASC 842 by outlining the timeliness and status of tasks and objectives, keeping all parties informed throughout the process