Manufacturing

INDUSTRY

4,500

EMPLOYEES

$750M

ANNUAL REVENUE

VIP SOLUTIONS CASE STUDY

Manufacturing

INDUSTRY

4,500

EMPLOYEES

$750M

ANNUAL REVENUE

Our client experienced an extraordinary disruption to the business stemming from an ERP implementation across the organization.

Following 4 months of system instability, the company has posted over $75M of unapplied payments to their AP aging. Due to deficiencies in purchasing and receiving, the company had been unable to properly process $69M of invoices. This caused them to have to pay vendors based upon statements rather than planned cycles of due invoices. Vendors began requiring large sum payments to prevent cutting off shipments to our client, risking disruption of service.

Establish process to pay urgent vendor payment requests on a weekly basis

Establish process to funnel urgent vendor communications through an approval process for expedited payments

Set up disbursement council to review and approve weekly payment plans to keep vendors on track

Develop plan to pay priority needs of the business based upon limited cash availability

Established a process to report weekly payment requirements from vendor requests

Established a disbursement council which met daily to ensure requests were communicated and payments were approved

Managed between $15M-$20M of weekly disbursements to ensure our client's vendors did not terminate agreements

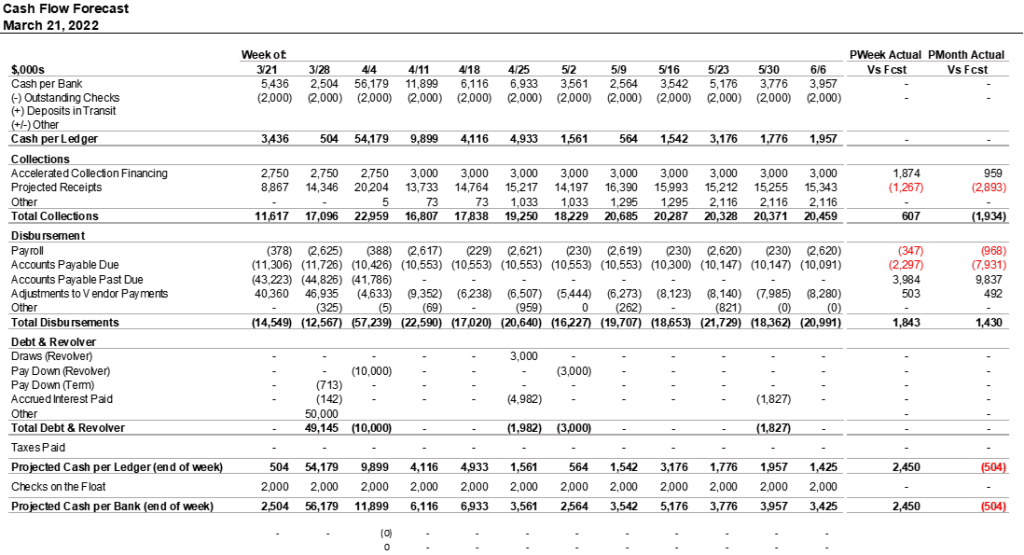

Our team developed and utilized the reporting document below to track payment requests and disbursements, preventing a disruption of production and service.