EBITDA Scrub & Addback Restatement

VIP SOLUTIONS CASE STUDY

Manufacturing

INDUSTRY

4,500

EMPLOYEES

$750M

ANNUAL REVENUE

BACKGROUND

Our client experienced an extraordinary disruption to the business stemming from an ERP implementation across the organization. Following a period of cleaning up and restating 9 months of activity, it became clear that the impacts to the business far exceeded forecasts.

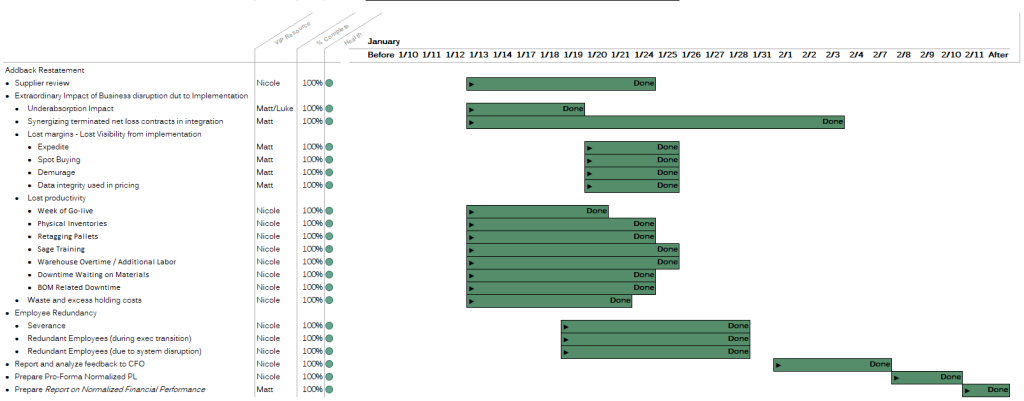

VIP was asked to conduct a scrub of financial performance to identify non-recurring impacts and report these as addbacks for an adjusted EBITDA. This “EBITDA Scrub” included an evaluation of the circumstances that impaired decisions during the period of system instability.

OBJECTIVES

Conduct detail analysis to identify monthly performance deficiencies

Evaluate business impacts for recurring and non-recurring nature, including the sources of the impacts

Prepare pro-forma normalized performance after carving out non-recurring activities

Prepare report of normalized financial performance

SOLUTIONS

Prepared analysis of contribution margins, labor efficiency, and contract pricing efficiency, isolating $40M of losses for non-recurring evaluation

Deep dive analysis on the cause of losses incurred by the business

Prepared carve out financials for an additional $36M of addbacks

Worked with functional leaders to inform operational changes to address deficiencies

Delivered report on normalized financial performance for distribution to investors

STATUS DOCUMENTATION