“Holy Grail” Contribution Margin Analysis

VIP SOLUTIONS CASE STUDY

Manufacturing

INDUSTRY

4,500

EMPLOYEES

$750M

ANNUAL REVENUE

BACKGROUND

Our client experienced an extraordinary disruption to the business stemming from an ERP implementation across the organization. Following a period of cleaning up and restating 9 months of activity, it became clear that the impacts to the business far exceeded forecasts.

VIP was tasked with developing a contribution margin analysis of all goods sold during the 2021 period in order to better understand what goods drove losses in the period, and why.

PROJECT RESOURCES

Matthew Edwards

Managing Director

- 15+ Years & Over 30,000 Hours of Client Service

- $76M Cash Recovered for Clients

- Executed 30+ Acquisitions

OBJECTIVES

Create standard margin analyses of all products sold

Roll up production variances, cost variances, and purchase price variances into the finished goods lots to attribute variances to orders

Evaluate over $12M of cycle count variances to isolate drivers and attribute cost to the finished good product lines on a ratable basis

Evaluate over/under L&OH by plant to attribute to the finished goods product lines

SOLUTIONS

Prepared contribution margin analysis that identified three net loss contracts on 25% of monthly revenues

Identified spread margin contraction across all ingredients, resulting in $44m contraction:

- Identified significant deficiencies and errors in pricing ($20m)

- Identified supply chain disruption due to excess market purchasing ($12m)

- Identified labor & overhead downtime ($12m)

Restated 9 months of activity in 75 days and informed significant business transactions that are expected to result in

$75M EBITDA TURNAROUND IN 2022

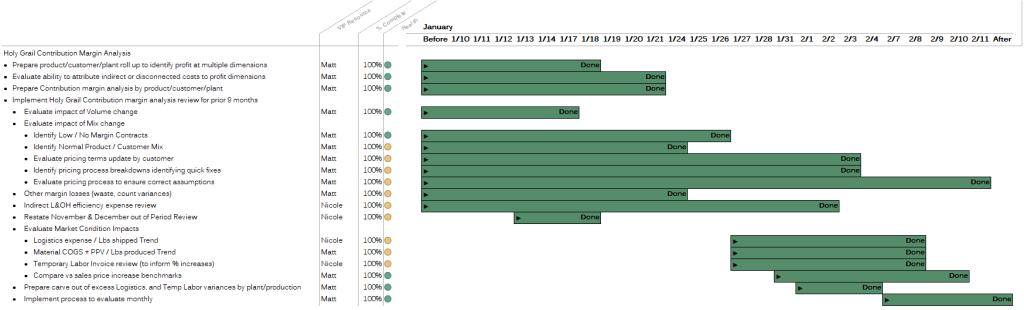

STATUS DOCUMENTATION