WRITTEN BY MATTHEW EDWARDS, DIRECTOR OF CLIENT SERVICES

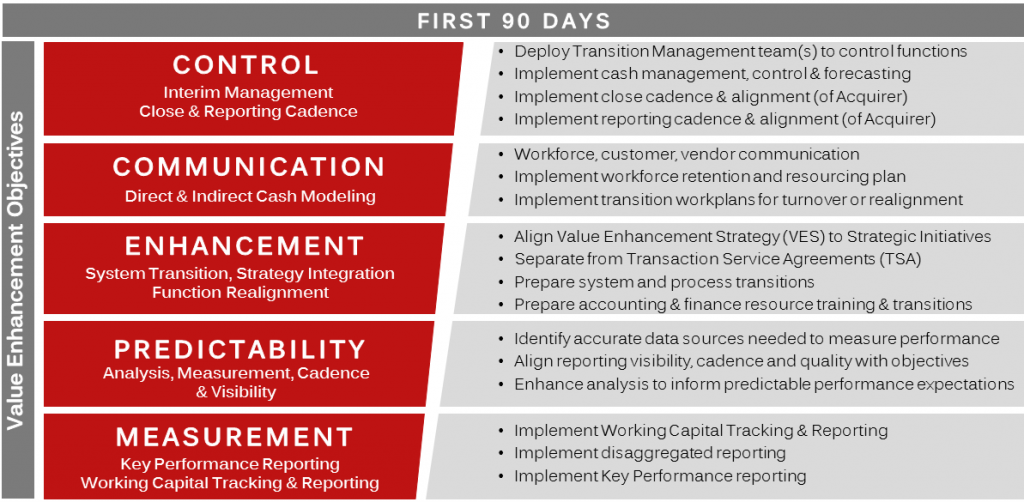

Equity sponsors invest for one simple reason – value enhancement. We believe that the value of what we are buying will appreciate, either passively or by our influence to enhance the value. Every acquisition articulates a deal thesis and value enhancement strategy to achieve the ROI which would justify the investment. Basic corporate investment strategy that, in theory, should deliver. Where does that go wrong? Without a 90 day plan, acquisitions face challenges with execution.

Execution

The value enhancement strategy execution and timeline often is dragged out by conflicts, unanticipated influences, or simply distractions in the organization or management. What was planned for day 1 becomes day 91, and we begin the slow process of eroding the value enhancement opportunity.

If we know these are the challenges that will be experienced in every deal, by the simple nature of the disruption of change of leadership and strategy, then why not directly confront those challenges with a structured plan – step by step – to implement the value enhancement strategy.

It’s like trying to build your own house without an architects’ plan or general contractor. The only logical solution is supplementing with accountable team members focused on the simple charter of implementing the value enhancement strategy.

90-Day Planning

My private equity sponsors probably get tired of hearing me pound the table about 90 day planning. I tell them – you can have your value enhancement strategy well on its way and delivering in the first 90 days with the right focused, accountable team.

Sometimes the message is received, sometimes they call me on day 91.

Our 90 day planning and execution of stair-stepped tasks clearly defines how we will meet objectives and deliver value enhancement on time. If you are interested in learning more about our 90 day planning approach, schedule a call with me at a time that is convenient for you.

AUTHOR

Managing Director of Client Services